Creating a Digital Trust Infrastructure for a National Financial Advisory Firm

- Client: National Wealth & Insurance Advisory Firm

- Industry: Finance & Legal & Insurance

- Problem: Low digital trust, compliance friction, bad SERP optics

- Solution: Trust-first website rebuild, entity SEO, reputation suppression, LinkedIn authority, video systems

- Result: Higher-quality inbound leads, faster sales cycles, lower compliance risk

Core Problem

Outdated digital presence, compliance risk, and negative search results were eroding trust with high-value prospects.

Transformation

We turned a fragmented, risk-prone online footprint into a controlled “digital trust infrastructure” that attracts, qualifies, and reassures high-value clients before they ever speak to an advisor.

Services Delivered

Client Context

- National wealth & insurance advisory firm with multiple offices and licensed advisors across the country

- Serves mid–high net worth individuals, business owners, and professionals

- Operates under strict financial services and insurance regulations

- Growth strategy depended on referrals + digital discovery (Google + LinkedIn)

Core Challenges

- Outdated, fragmented website

- Old design, slow load times, poor mobile experience

- Multiple microsites and advisor pages not aligned with brand or compliance

- Compliance bottlenecks & risk exposure

- Every small content change needed manual review

- No standardized messaging = advisors improvising language, creating regulatory risk

- Damaging search results & review noise

- Old directories, mixed reviews, and third-party pages ranking above official site

- Previous complaints and low-quality content visible on page 1 for brand searches

- Weak leadership presence on LinkedIn

- Key partners had incomplete, inconsistent profiles

- Company page was inactive and not positioned as a serious authority

- Trust friction in the sales process

- Prospects arriving skeptical, asking “Are you legit?” and “Who actually regulates you?”

- Advisors spending time defending credibility instead of advising

In short: they were doing serious financial work, but their digital footprint made them look risky, inconsistent, and behind the times.

Strategy & Solution

We designed the project around one goal: build a digital environment where regulators, Google, and prospects all see the same thing — a controlled, trustworthy, authoritative firm.

We executed across 5 strategic pillars

1. Digital Trust Architecture & Website Rebuild

What we did

- Rebuilt the entire corporate website as a single, compliant “source of truth”

- Structured content around services, regulations, and client journeys (not internal org chart)

- Implemented fast, secure, mobile-first UX with clear trust signals: licenses, disclosures, regulators, and safety FAQ

- Consolidated scattered microsites into one controlled domain strategy

Why it mattered

- In finance, the website is a credibility check, not just a brochure

- A clean, fast, secure, consistent site instantly reduces perceived risk

How it solved key issues

- Removed confusing, outdated pages that were undermining trust

- Gave compliance one central place to control copy and disclosures

- Created a coherent experience from Google → homepage → contact

2. Compliance-Proof Brand Messaging & Copy System

What we did

- Created a brand messaging framework and tone that fits both marketing and compliance

- Standardized key claims, disclaimers, product descriptions, and risk language

- Built a library of pre-approved messaging blocks for services, FAQs, and advisor bios

- Trained internal team on how to use the messaging system safely

Why it mattered

- Most financial firms either sound too salesy (compliance nightmare) or too vague (no conversion)

- They needed language that was clear, honest, and compliant — without killing performance

How it solved key issues

- Reduced approval cycles because content used pre-reviewed blocks

- Protected the firm from advisors “freestyling” risky language

- Created a consistent story across website, PDFs, LinkedIn, and video

3. Technical & Entity SEO + Reputation Suppression

What we did

- Ran full technical SEO audit: crawlability, indexation, schema, speed, security

- Implemented entity SEO: structured data, consistent NAP, knowledge panel optimization, and unified company + executive profiles

- Built content and internal linking around high-intent keywords plus brand protection terms

- Developed and executed a reputation suppression plan:

- Created and optimized additional owned assets (blog, guides, media mentions)

- Strengthened profiles on high-authority directories and industry platforms

- Targeted link-building to authoritative, relevant sources

Why it mattered

- When people search your name in finance, page 1 of Google is your real homepage

- If negative, outdated, or confusing assets outrank you, trust is lost before any pitch

How it solved key issues

- Pushed old/negative third-party pages down in the results

- Elevated controlled, compliant assets up on page 1

- Clarified who the firm is and how it is regulated in Google’s “eyes”

4. LinkedIn Authority & Executive Positioning

What we did

- Rewrote and optimized leadership and key advisors’ profiles: headline, “About,” experience, featured content

- Rebuilt the company page with a clear positioning statement and proof points

- Designed a 3-month LinkedIn content calendar focused on education, not hype

- Built lightweight routines for advisors to share approved content consistently

Why it mattered

- In B2B and high-net-worth segments, LinkedIn is often the second touch after Google

- If leadership looks invisible or generic, deals stall

How it solved key issues

- Gave prospects a clear, confident, and human view of the firm’s expertise

- Aligned what people see on LinkedIn with what they see on the website

Supported business development with better connection acceptance and reply rates

5. Video Explainers & Compliance Training Systems

What we did

- Produced short, clear explainer videos on:

- How the firm is regulated

- How advice is given and conflicts are managed

- What clients can expect in the first 90 days

- Built internal compliance training videos to support consistent messaging across staff

- Integrated videos into key pages (homepage, “Why Us”, onboarding) and advisor follow-up sequences

Why it mattered

- Video lowers anxiety faster than text, especially when money and risk are involved

- Internally, repeatable training reduces accidental non-compliant behavior

How it solved key issues

- Reduced repetitive “trust and process” questions in sales calls

- Ensured new hires and advisors stay aligned with approved narratives

- Turned compliance from a brake into a guardrail that lets marketing move faster

Results

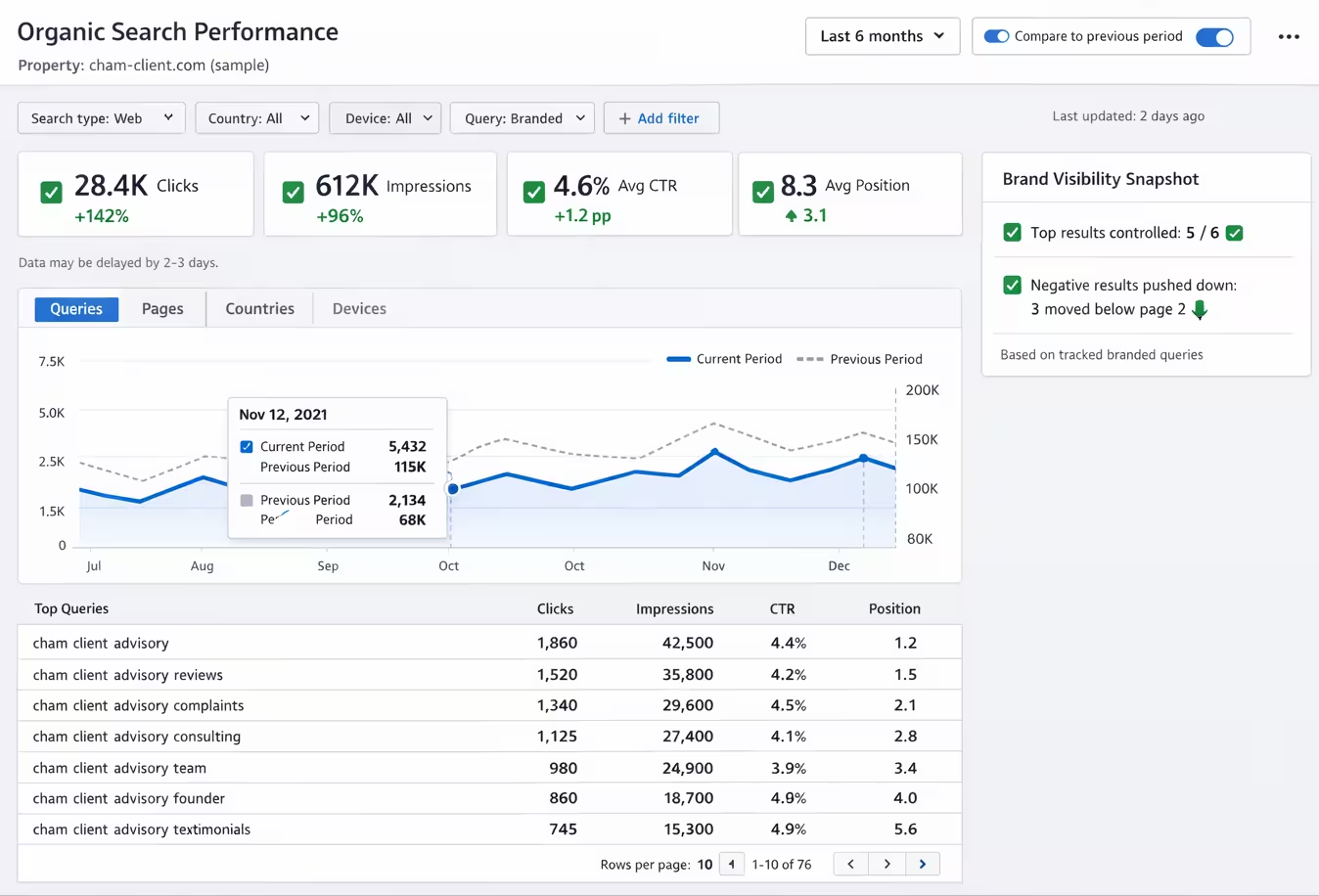

Results below measured over 9 months post-launch vs. previous 9-month baseline

+142% organic traffic

from organic & direct traffic

3.8× increase in consultation requests

from organic & direct traffic

62% increase in time on key trust pages

(regulation, “How We Work,” and advisor profiles)

5 of top 6 Google results

for brand name now controlled by official assets (website, LinkedIn, trusted directories) vs. 2 of 6 before

3 previously prominent negative/low-quality results

pushed below page 2

0 compliance escalations

tied to website or marketing content in 9 months (down from 6 in the prior year)

47% reduction in “credibility-check” objections

recorded in CRM notes during early sales calls

2.9× increase in LinkedIn profile views

for key partners and 2.3× increase in InMail reply rate from target prospects

Outcome Summary

The consultant shifted from a referral-dependent practice to a repeatable, inbound-powered authority brand, with systems that support bigger deals and a smoother client journey.

Deliverables & Timeline

Strategic Deliverables

- Digital Trust & Compliance Content Architecture

- Brand messaging framework tailored to regulated financial services

- Reputation and search risk map with prioritized suppression plan

- LinkedIn authority positioning blueprint for leadership

Tangible Assets

- New corporate website (40+ strategically structured pages)

- Pillar content: 10+ in-depth articles + 30+ FAQ/knowledge base entries

- 3 client-facing explainer videos + 1 corporate story video + micro-clips for LinkedIn

- Internal compliance/brand alignment training videos

- Governance rules: content workflows, approval checklists, and publishing guidelines

High-Level Timeline

- Month 0–1: Discovery, compliance workshops, technical & reputation audits

- Month 2–3: Messaging framework, IA and UX design, content outline, wireframes

- Month 3–4: Full website build, copywriting, SEO implementation, initial suppression actions

- Month 4–5: Launch, tracking setup, LinkedIn optimization, first wave of authority content

- Month 5–7: Scale content, expand link-building, roll out video systems, refine based on data

Why This Project Succeeded

- We started from trust and regulation, not from “pretty design.”

Every decision — layout, wording, microcopy — was filtered through the lens of “Does this improve perceived and actual safety?” - We treated the firm as an entity, not a website.

We aligned what Google, LinkedIn, directories, and review sites show about the firm, so everything reinforces a single, credible story. - We turned compliance into a speed enabler.

By building pre-approved messaging blocks and clear guardrails, marketing can now move fast without triggering red flags. - We integrated reputation management into SEO, not as a separate crisis tool.

Suppression and authority building were baked into ongoing content, link-building, and profile optimization — not just one-off “damage control.” - We focused on the moments that actually change deals.

First impression on Google, first scroll on the site, first look at LinkedIn, and first explanation of “how it works” – we rebuilt each of those to reduce fear and confusion.

What the Client Said & What We Learned

We didn’t need more marketing noise. We needed someone who understood the regulatory box we live in and could still help us grow. Now when prospects find us online, they see exactly what we’d want them to see: stability, clarity, and control. Our advisors spend less time proving we’re legitimate and more time actually advising

Agency Insight

In regulated markets, your real brand is what shows up when someone Googles you at 11:30 pm after a long day.

If you don’t control that surface, someone else — or an old complaint — will

Want This Level of Digital Authority?

We build end-to-end authority stacks for high-fee consultants, advisors, and expert firms.